|

Fan fatigue does not bode well for the IPL's franchises at a time when they are looking to build additional revenue streams. Each year, there's a flurry of activity just before and during the IPL, after which there is a lull. But if the franchises are to become financially viable over the long term, they need to engage with fans all through the year. For a start, this will ensure that stadiums aren't empty. It will also boost merchandise sales, ticketing revenue and attract more sponsors.

In the US, every home game of the Los Angeles Lakers in the National Basketball Association (NBA) league is sold out. The team has the most popular merchandise among all NBA teams. According to media reports, the team is valued at $643 million. Across the Atlantic, football club Manchester United's merchandise sales alone earned it £81.4 million in 2010, accounting for 28% of its total revenue that year.

All of this is the result of triumphs on the field and marketing success off it.

All of this is the result of triumphs on the field and marketing success off it.

Even taken together, the worth of the IPL franchises doesn't add up to the LA Lakers' worth. If anything, their valuations are falling. "We believe the IPL's long term value of $500 million has been destroyed. I think the franchises themselves are in a state of flux as game formats, talent depth and player wages are impacting both on-field and business performance," says M Unnikrishnan, Global Strategy Director, Brand Finance. Merchandise sales account for less than 5% of the franchises' revenue.

On the cost front, the players' astronomical salaries are hitting the franchises hard. In 2008, player salaries were capped at $5 million but this was raised to $9 million in the 2011 auction. That's certain to rise at the next one. According to a salaries survey of various sports by Sportingintelligence.com, the IPL is the world's No. 2 sporting league in terms of average pay (on a weekly pay basis), second only to the US National Basketball League. Royal Challengers Bangalore is No. 26 in the team list with weekly wages of $86,667 and Kolkata Knight Riders 29th with $85,545. Kings XI Punjab (40) and Mumbai Indians (44) are the other IPL teams in the top 50. Spain's Barcelona was No. 1 at $152,130 while rival Real Madrid was second with players earning $141,474 a week.

Central Pool Dependence

|

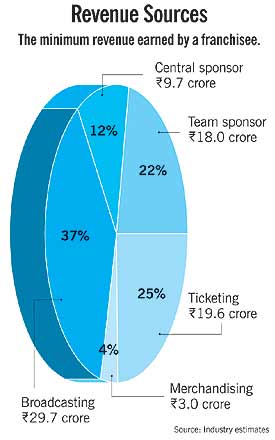

Analysts estimate that the franchises earn about 50% of their revenues from the central revenue pool, which consists of a franchise fee, broadcast rights fee, in-stadia sponsorship and new media rights fee. Gate receipts and local sponsors account for another 46% or so, while merchandise accounts for around 4%.

"The way it was structured was that in the infant stage, most of the revenue would come from central pool revenue, which would decrease with time, to put more pressure on the franchises to create their own revenue stream," says Balu Nayar, MD, Morpheus Fund. But considering that merchandise accounts for less than 5% of revenue, it's clear that the franchises haven't built alternative revenue streams.

Clearly, if the owners want their franchises to evolve into strong brands over the long term and become the Lakers and Manchester United of the cricket world, they have a job on hand. "At a franchisee level, only the 'break-away brands' like Chennai Super Kings, Royal Challengers Bangalore and Mumbai Indians will deliver sustainable profits in the next two-three years. They are executing on key drivers across marketing, cricketing and governance in a consistent fashion," says Unnikrishnan. A report by Brand Finance shows that these teams are ahead of the others in terms of on-field performance; individual players' strengths; separation of ownership and management; brand leverage; ability to attract sponsors; merchandising deals; and stadium capacity.

|

The teams have also been engaging with fans in different ways. Mumbai Indians has an 'education for all' programme while Chennai conducts non-cricketing contests for schoolchildren along with national daily, The Hindu. RCB has tied up with cricket clubs and partners local initiatives to increase its fan base and develop new cricketing talent. "The fan base has to be built towards the franchise model. Right now it's still focused on the stars," says Rohit Gupta, Executive Vice-President, Advertisement Sales and Revenue Management, Sony Entertainment Television.

Every stadium boasts of corporate boxes and receipts from this premium seating make up a big chunk of stadium earnings. For instance, the Rajasthan Royals has 1,200 seats in corporate boxes, with tickets costing between Rs 9,000 and Rs 12,000. The Eden Gardens stadium in Kolkata has 32 corporate boxes of 20 seats each and KKR's takings from them will be quite high—provided the boxes are occupied.

Affordable ticket prices are also important to improve attendance. "Our gate collections account for about 20% of revenues, but it should go as high as 50%," says Morris of Rajasthan Royals. Nayar feels that corporate boxes can be sold for a higher price and the proceeds could be used to subsidise other seats. "If you don't have stadiums filled up, it is a sign of things declining, whether you make money from it or not," he warns.

Better stadium infrastructure—comfortable seating, entertainment, food and beverages, shopping areas, parking and safety measures—can also go a long way in attracting fans. "A good environment in the stadium will mean fans can come and hang out before and after a match. If you look at English Premier League stadiums, they have a mall alongside. It's a package deal. I can clearly see movement toward that direction for stadiums in Mumbai, Chennai and Bangalore," says India Cements' Singh.

Perhaps it's not that much of a choice anymore. If the owners want their franchises to become moneyspinners, they will have to do everything they can to build loyalty among fans.

No comments:

Post a Comment